how to claim eic on taxes

If updated the 2021 tax year PDF file will display the prior tax year 2020 if not. Additional child tax credit.

Two Websites To Get Your W2 Form Online Online Taxes Filing Taxes W2 Forms

Notice about the EIC.

. Most state programs available in January. Form 8332 Release of Claim to Exemption for Child of Divorced or Separated Parents. Their earned income credit EIC child tax credit CTCadditional child tax credit ACTC credit for other dependents ODC or American opportunity credit AOTC was reduced or disallowed for any.

However to claim a college student as a dependent on your taxes the Internal Revenue Service has determined that the qualifying child or qualifying relative must. If you claim the foreign earned income exclusion the housing exclusion or both you must figure the tax on your nonexcluded income using the tax rates that would have applied had you not claimed the exclusions. In the vast majority of cases its best for married couples to file jointly but there may be a few instances when its better to submit separate.

How much you may get in 2022. This penalty is capped at 25 percent. However if youre self-employed you have to pay both portions of this tax.

Citizens and can find more information in other IRS publications at IRSgovForms. Ad Access IRS Tax Forms. Be under age 19.

At the auction the church received and accepted a bid from Lauren Green equal to the fair rental value of the home for 1 week. About Form 8862 Information To Claim Certain Credits After Disallowance. Generally a wash sale is what occurs when you sell securities at a loss and buy the same shares within 30 days before or after the sale date.

Married couples have the option to file jointly or separately on their federal income tax returns. Complete Edit or Print Tax Forms Instantly. Whether youre self-employed or an employee youll have to pay Social Security and Medicare taxes to the government.

Generally a parent can claim your college student children as dependents on their tax returns. Last year many of the federal income tax forms were published late in December with instructions booklet following in early January due to last minute legislative. To file as head of household you must furnish over one-half of the cost of maintaining the household for you and a qualifying person.

State programs can be added within the program for an additional cost. Wash sale rules are designed to prevent investors from creating a deductible loss for the purpose of offsetting gains with only a short interruption in owning the security. You can elect to use your 2019 earned income to figure your 2021 earned income credit if your 2019 earned income is more than your 2021 earned income.

If you are not married or if you decide to file as Married filing separately. You cant deduct the wages and employment taxes paid for your household employees on your Schedule C or F. We will also discuss eligibility requirements and how to claim the EIC credit.

For details see Pub. Temporary disability such as an injury serious medical condition or even pregnancy can be covered by short-term disability payments obtained through private insurers and they may be part of an employers compensation to employees. Weve Got You Covered.

Tax Forms included with TurboTax CDDownload products. The information in this publication is not as comprehensive for resident aliens as it is for nonresident aliens. Theres no specific cutoff point or age.

However you can claim a deduction for one-half of the self-employment taxes you pay. 514 Foreign Tax Credit for Individuals. Citizens and resident.

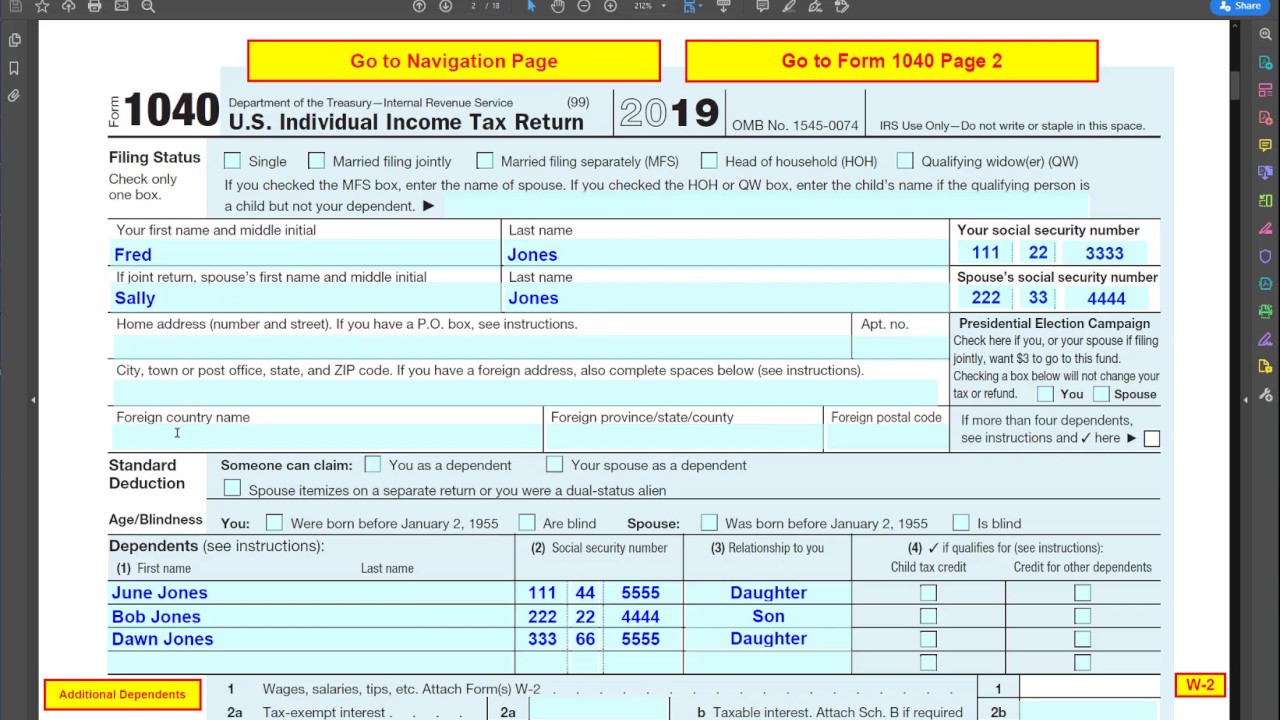

Generally you can expect the IRS to impose a late payment penalty of 05 percent per month or partial month that late taxes remain unpaid. You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets the Internal Revenue Services definition of a qualifying relative Dont get tripped up by the word relative hereaccording to the IRS it can include an unrelated person who passes the four following tests concerning. Schedule EIC Form 1040 or 1040-SR is used by filers who claim the earned income credit to give the IRS information about the qualifying child.

Lauren cant claim a deduction either because she received a benefit equal to the amount of her payment. File Your Taxes for Free. Therefore only one of the parents will have contributed more than one-half of the cost of maintaining the household and be eligible to file.

Schedule K-1 and earned income credit Schedule EIC. See Contributions From Which You Benefit. The IRS strongly encourages most couples to file joint tax returns by extending several tax breaks to those who file together.

See what it is how it works how to qualify. The earned income tax credit EIC or EITC is for low- and moderate-income workers. You must note on your tax return that a taxpayer can claim you however if you meet all the qualifying rules as their dependent and youll lose some tax breaks if they do.

Earned Income Credit EIC The parent claiming the child for the tax year will be able to claim all of these. Prior year 2019 earned income. No only one parent may claim the child as a qualifying child to file as head of household.

Release dates vary by state. Penalty for late payments. Ad Fill IRS Form 886-H-EIC Printable Fillable Blank.

Back to Frequently Asked Questions. Schedule EIC Earned Income Credit. If you are required to use your personal vehicle for work can you claim gas on taxes or do you just use the standard mileage deduction.

Mandy cant claim a deduction because of the partial interest rule. When you work for someone else youre only responsible for part of these taxes while your employer pays the balance. The custodial parent may still be able to claim the child as a qualifying child for the earned income credit if the residency test and all the other.

Claim for refund process. Schedule SE Self-Employment Tax. Whether the payments are taxable depends on how and when they are paid.

EIC line item instructions follow later as part of the Form 1040 general instructions booklet. Resident aliens are generally treated the same as US. Form 8379 Injured Spouse Allocation.

TurboTax Personal Taxes IRS Forms Schedules. If you are married in most cases it is more beneficial to file jointly and claim your children as dependents. A Form 1040-X to claim or change a foreign tax credit or deduction for foreign taxes must generally be filed within 10 years from the due date for filing the return without regard to any extension of time to file for the year in which the foreign taxes were actually paid or accrued.

Information about Schedule EIC Form 1040 or 1040-SR Earned Income Credit including recent updates related forms and instructions on how to file. No the noncustodial parent may not claim a child as a qualifying child for the earned income credit based solely on the custodial parents release of a claim to exemption for the child. Other Tax Forms and Schedules.

The EIC is a tax credit available to working individuals and families who earn low to moderate incomes. In this article we will provide an Earned Income Credit Table that shows how much you could get back from the IRS based on your income level and filing status. Table A provides a list of questions and the chapter or chapters in this publication where you will find the related discussion.

Need to Fill Out and Sign 66b. Credit for other dependents. Be younger than the taxpayer or spouse if MFJ and.

Chapter 2 discusses the withholding of income social security and Medicare taxes from the pay of US. Technically youre independent as long as no one else claims you as a dependent. It is usually more beneficial for the parent with the higher income to claim the children.

If the corrected Schedule H is filed with a Form 1040-X or an amended Form 1041 claim a refund by indicating that you would like the overpayment refunded to you on. Custodial parents can give the noncustodial parents the right to claim their custodial parent tax benefits. The amount of investment income you can receive and still be eligible to claim the EIC has increased to 10000.

Ad Complete IRS 1040 - Schedule EIC 2017. Apply for an Employer ID Number EIN.

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

Tax Filing Without The Headaches Illinois Earned Income Tax Credit Simplified Filing Pilot

Form 1040 Earned Income Credit Child Tax Credit Youtube

Eic Frequently Asked Questions Eic

Earned Income Tax Credit 2013 1040return File 1040 1040ez And 1040a Forms Online

Irs Courseware Link Learn Taxes

What Is The Earned Income Credit Check City

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Earned Income Credit Tax Law Changes For Tax Year 2021 And Beyond Tax Pro Center Intuit

Summary Of Eitc Letters Notices H R Block

.png)

What Is The Earned Income Credit Check City

How To Claim An Earned Income Credit By Electronically Filing Irs Form 8862

4 Tips For Notaries Claiming Home Office Tax Deductions Notary Notary Public Business Notary Jobs